I am the Director of Industry Analysis at the World Steel Association. World Steel Association, or worldsteel in short, is the global association of steel producers, national and regional steel industry associations, and steel research institutes.

Our members represent around 85% of global steel production. Being a global organization of steel producers, we aim to provide global leadership in all major strategic issues impacting the steel industry, particularly focusing on economic, environmental and social sustainability.

Currently, I am responsible for identifying the most pressing issues along the steel value chain, from raw materials and energy markets to steel and steel consuming industries such as automotive and construction, carrying out studies on these issues and providing our members with the necessary timely and world-class intelligence and foresight into the issue.

I joined worldsteel in January 2010, and since then I have conducted daily analysis of steel industry statistics, economic data and events. I have had the opportunity to lead many interesting research projects to develop a deeper understanding of important steel industry developments and also the forces that are likely to shape the future of the steel industry’s future, such as climate change. I have also had the chance to present our views at various conferences and exchange opinions with steel industry stakeholders.

We did a study in 2019 to provide a comprehensive overview of shipbreaking activities and its ESG practices, to develop a clear understanding of risks associated with responsible sourcing of ferrous scrap for the global steel industry.

We saw that there were about 30 countries with operational shipbreaking facilities in 2018. However, only four countries, India, Bangladesh, Pakistan and Turkey accounted for more than 90% of the ships broken (bigger than 500 Gt) in 2018.

The market was even more concentrated for larger ships, as almost all the bigger ships were broken in India, Pakistan or Bangladesh. We understood that the ship recycling practises followed in many shipbreaking yards in India, Bangladesh and Pakistan failed to comply with environmental or safety standards in many respects. Some shipbreaking yards in these countries have been investing in infrastructure and trying to follow more responsible practices. Nevertheless, reportedly, the practices have remained poor by international standards at many shipbreaking yards. We also understood that ship scrap steel was mainly reused in India, Pakistan and Bangladesh after a very primitive re-rolling and treatment process. In India particularly, some smaller iron bearing parts were melted in induction furnaces. Scrap exports from India, Bangladesh and Pakistan were negligible and mostly destined for India. Therefore, we concluded that ship scrap steel generated in India, Pakistan and Bangladesh was mostly re-used or melted in induction furnaces in these countries and did not make it into international scrap trade flows. That is, for the global steel industry the risk of using any scrap steel generated in shipbreaking facilities with poor ESG practices in India, Pakistan and Bangladesh was negligible.

We also understand that responsible shipbreaking practices have been established over the last several decades. That is, it is possible to break a ship, recover the recyclable materials and dispose of the toxic materials in responsible ways. We estimated that about 15 Mt of additional ferrous scrap could be brought to scrap market every year, if all scrapped ships were broken in shipbreaking yards that meet international ESG criteria. We understand that decarbonization pressures might boost ship scrapping in the rest of the 2020’s and in the early 2030’s, as ship owners act to decrease their fleet emissions by replacing older ships in their fleets with new ships that have a low CO2 emissions intensity.

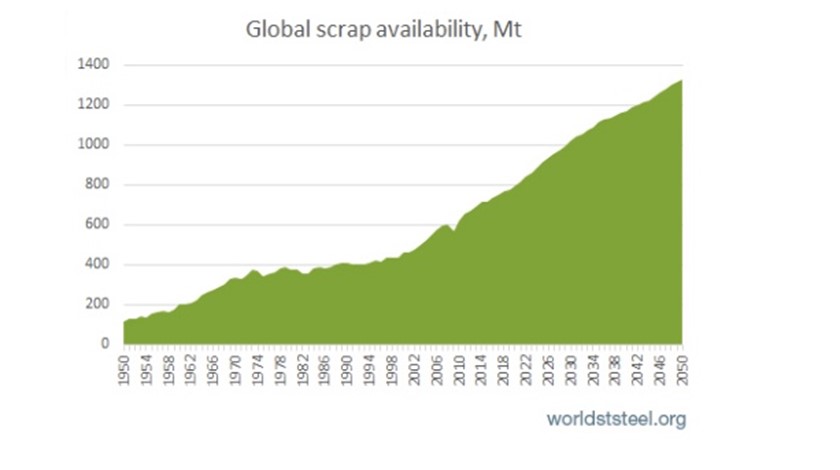

Global scrap availability is expected to grow strongly over the next several decades. This will be one of the biggest levers for the global steel industry in its decarbonization challenge. We estimate that global obsolete scrap availability stood at about 430 Mt in 2021 and is expected to grow to about 600 Mt by 2030 and 900 Mt by 2050. Ferrous scrap accounted for 32% of the global steel industry’s metallics requirements in 2021. In 2050, thanks to increasing scrap availability and the steel industry’s decarbonization efforts, scrap is expected to account for about 50% of the global steel industry’s metallics requirements.

As the global steel industry we would wish to see all ships being recycled in responsible facilities that meet the most stringent international ESG criteria. We hope that the ship recycling industry makes great strides in this direction in the coming years. This would also bring significant amounts of ferrous scrap to the global scrap market and thereby help the global steel industry in its decarbonization challenge.